Author: KP & Associates

Feb 6, 2026 / Blog

A Wake Up Call for Home Owners. Why Silence Isn’t Golden.

Community Safety Alert 🚨

Earlier this week, a fire on Edgar Avenue in Alton Village was a stark reminder of how quickly everyday life can turn into an emergency. We’re grateful for the fast response from Burlington Fire, and it’s a cue for the rest of us to do one simple thing today:

Check your smoke alarms.

Most of us forget about them unless they chirp at 3 a.m. But smoke alarms are the one thing in your home that must work perfectly, all the time.

What most homeowners don’t realize:

- Changing batteries when the clocks change isn’t enough

- Smoke alarms expire after 10 years, the sensors degrade

- Many homes still have original builder-grade alarms that are now past their lifespan

If your alarm is over 10 years old (check the date on the back), it needs to be replaced, not just re-batteried.

Quick safety check (10 minutes):

- Test every alarm

- Check the manufacture date

- Vacuum dust from the unit

- Check carbon monoxide detectors (5–7 year lifespan)

The best way to support our neighbours, and our firefighters, is to make sure we’re not the next emergency call.

If you have elderly neighbours, offer to help.

Stay safe, Burlington 🧡

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Jan 14, 2026 / Blog

Land Transfer Tax (LTT): The closing cost most buyers don’t budget for

When you buy a home in Burlington, there is a cost called Land Transfer Tax. This is a one-time tax paid to the province when you buy a home. You pay it on closing day.

For many buyers, this is the biggest cost after the down payment.

Good news for Burlington buyers

If you buy a home in Burlington, you only pay Ontario’s land transfer tax. Buyers in Toronto have to pay two land transfer taxes, which costs a lot more. This means Burlington buyers usually pay much less.

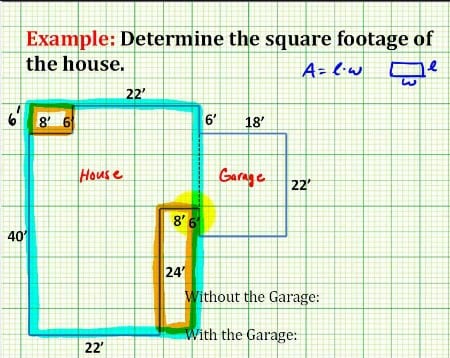

How land transfer tax works

Land transfer tax is not one flat rate. Ontario uses steps.

Each part of the home price is taxed at a different rate. As the price goes up, the tax goes up too.

Example: $900,000 home in Burlington

If you buy a home for $900,000, your land transfer tax is about: $14,475

This is because:

- The first part of the price is taxed at a low rate

- Higher parts of the price are taxed at higher rates

First-time homebuyers may pay less

If this is your first home, you may get a rebate of up to $4,000. This means you could pay much less land transfer tax. Your lawyer usually applies this rebate for you.

When do you pay it?

📌 You pay land transfer tax on closing day

📌 Your lawyer collects it

📌 It cannot be added to your mortgage

This means you must have the money ready ahead of time.

Plan ahead

Land transfer tax is a big cost. Knowing about it early helps you avoid surprises.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Dec 10, 2025 / Blog

MARKET INTELLIGENCE REPORT – SPECIAL EDITION

Why everyone is right about real estate, depending on which market they’re in.

A Smart Client Raised a Big Question…

A longtime, savvy client of ours, someone who has bought a tremendous amount of real estate over the years, recently sent us a video claiming condo prices are down substantially.

So it raises a fair question: with so many conflicting narratives, can everyone actually be right?

The surprising answer: Yes. And here’s why.

This Is Not One Market, It’s Three.

This is the single most significant misunderstanding in real estate commentary today.

Ontario real estate isn’t one market, and at this moment, the gaps between its segments are wider than ever. As luxury agents, we focus primarily on:

- Super-Luxury Market: $5M+

- Luxury Market: $2M+

These two segments behave entirely differently from the overall market.

Today, it feels as though we’re working in three entirely separate ecosystems:

- Super-Luxury ($5M+)

- Luxury ($2M–$5M)

- The Overall Market (all segments combined)

And each is being driven by very different forces.

Why Luxury Outperforms (Even When Headlines Say Otherwise)

Because of widening wealth disparity and concentrated liquidity at the high end, luxury remains extremely resilient.

Super-luxury and luxury buyers are far less sensitive to interest rates.

They’re not relying on traditional financing. They’re driven by lifestyle, wealth preservation, and long-term asset allocation.

Meanwhile…

The overall market is still weighed down by high mortgage rates, behaving in a more traditional boom/bust cycle. This is how two people can look at the same area and come to opposite conclusions, and both be correct.

Real Estate Is Local, Right Down to the Street

We work predominantly across Southern Ontario, where demand remains exceptionally strong. But even within a single region:

- One neighbourhood can be in a lull,

- While the next street over is red hot.

Micro-markets matter more today than ever.

A Decade of Forces That Created Today’s “Flat” Big Picture

Here’s a quick snapshot of what shaped the last 10 years:

2015–2017: – Low-rate environment → explosive luxury demand + strong condo pre-construction cycle.

2020: COVID froze the market for ~6 months as everyone waited for clarity.

2021: Record-shattering rebound fueled by pent-up demand + near-zero interest rates.

2022–2024: Aggressive rate hikes (mortgages jumped from ~2.75% to 6%+) slowed the overall market.

But luxury remained resilient, and cash-heavy buyers continued transacting.

All of these forces counterbalanced each other, creating what now appears to be an overall “flat” decade. But that’s the 10,000-foot view. Inside the segments, the story is much more dynamic.

Where Experts Agree: The Next Cycle Begins in 2026

Across major banks, economists, and institutional analysts, the consensus is clear:

2026 is expected to mark the start of a meaningful upward cycle.

Here’s why:

- Rates are projected to ease.

- Pent-up demand is building.

- Inventory remains consistently high.

- Immigration and interprovincial migration continue to strengthen demand.

- Investors are re-entering as borrowing conditions normalize.

Many forecasts suggest significant appreciation over the next decade, particularly in luxury and trophy assets.

So, Yes, Everyone Could Be Right

The market isn’t crashing.

The market isn’t exploding.

Different segments are doing other things.

What matters is not whether “Ontario is up or down.” But which market you are looking to MOVE into?

Let’s March On.

We’re entering one of the most opportunity-rich environments the luxury market has seen in years.

If you’d like a segment-by-segment valuation of your portfolio or want to position yourself strategically ahead of the 2026 cycle, we’re here.

Reply anytime. WE ARE ALWAYS IN YOUR CORNER!

Nov 20, 2025 / Blog

Here’s the dirty little secret no one likes to admit … your kid’s friends are growing up, and the social scene is getting ugly.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Nov 13, 2025 / Blog

The Daunting Beauty of Moving from One Home to Another

Moving from one home to another can be one of the most emotionally charged experiences in a person’s life.

It’s not just about boxes, bubble wrap, and moving trucks, it’s about transition, memory, and the silent goodbyes whispered through empty rooms.

A home is more than walls and a roof. It’s the laughter that echoed in the kitchen, the height marks on the door frame, the morning light that hit the same corner of the living room year after year. It’s the place where we’ve celebrated milestones, endured losses, and created a rhythm that feels uniquely ours.

So when the time comes to move, even when it’s by choice, the process can feel daunting, heavy, and strangely bittersweet.

We pack our things, but we also pack years of living. We fold up comfort, routine, and familiarity, hoping they will somehow unfold just as perfectly in the next place. And though the next home holds the promise of new beginnings, it also demands courage, the courage to let go.

For many, the move itself is a blur of logistics: realtors, closings, boxes, deadlines, and decisions that seem to pile up faster than we can process them. Yet beneath the surface, something far deeper is happening, a quiet act of renewal. Each move challenges us to redefine who we are and what truly matters. It strips away the unnecessary and reminds us that home is not just where we live, but how we live.

As someone who has guided countless families through this very process, I’ve seen the tears, the hesitation, the joy, and the relief. I’ve witnessed people walk through their old front door one last time, take a deep breath, and step into a new chapter. And every time, it’s a reminder that moving is more than a transaction, it’s transformation.

So if you’re in the middle of a move, feeling overwhelmed, sentimental, or uncertain, know this: it’s completely normal. You are not just relocating your belongings; you are carrying forward your story, and there’s beauty in that.

Each box holds not only possessions but pieces of your life. And when the last one is unpacked, you’ll discover that what truly makes a house a home came with you all along.

– Karen Paul

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Nov 6, 2025 / Blog

Selling soon? You might not be as ready as you think …… and it’s probably not for the reason you expect.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Oct 29, 2025 / Blog

Bank of Canada Cuts Rates ✂️. What Does It Means for You?

Exciting news for Canadians: the Bank of Canada just lowered the overnight rate by 0.25%, bringing it to 2.25%, and most lenders’ prime rates are now 4.45%.

If you have a variable-rate mortgage, adjustable-rate mortgage, or HELOC, your payments could drop soon. But this move isn’t just about saving a few dollars each month, it’s a sign of where the economy and housing market could be headed next.

Why the Bank Made This Move

Canada’s economy has been under pressure:

- GDP shrank by 1.6% last quarter

- Job growth is softening, especially in trade-sensitive sectors

- Inflation is stabilizing around 2.5%

With exports lagging and employment cooling, the Bank saw a chance to support recovery without risking runaway inflation.

What’s Happening in Real Estate

CREA reports that September 2025 was the strongest September for home sales since 2021, even with a small dip month-over-month. Supply is slowly growing, prices are stabilizing, and more buyers are stepping back in.

Today’s rate cut could give that momentum a boost heading into 2026.

Should You Make a Move?

If you’re:

- In a variable-rate mortgage

- Shopping for a new home

- Up for renewal or considering refinancing

…it’s a great time to revisit your strategy.

Next Important Date: The Bank of Canada will announce rates again on December 10, 2025, another shift could happen before the new year.

Let’s talk about what today’s change means for you and whether it’s time to update your mortgage game plan.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Oct 9, 2025 / Blog

Top Thanksgiving Pies & Treats in Burlington & Oakville

Thanksgiving is just around the corner, and nothing says “holiday season” like a slice of homemade pie!

Whether you’re hosting family, bringing dessert to a friend, or just treating yourself, Burlington and Oakville are full of bakeries serving up delicious seasonal pies and treats.

We’ve put together a curated list of our favorite local spots where you can grab the perfect pie this Thanksgiving:

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Oct 2, 2025 / Blog

Before You Sell That Country Property… Watch This First 👀

Out in the country, life feels simple, until it’s time to sell. Many rural homeowners are surprised to learn that selling a farm or country property can come with unexpected tax consequences. Between HST and capital gains, things can get messy fast if you don’t know what applies to you.

In this quick video, Justin breaks down the two biggest tax traps country sellers face, and how to avoid getting caught off guard.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Sep 25, 2025 / Blog

🗝️ Understanding Vacant Possession: What Every Seller Needs to Know

When selling a home, one key detail that can cause confusion is vacant possession.

Simply put, vacant possession means that the seller must have the home completely empty and ready for the buyer to move in at the time the deal closes.

It doesn’t matter if the transaction closes at 11:00 a.m., 2:00 p.m., or 4:30 p.m., the property must be vacant by that exact time.

A common misunderstanding involves the 6:00 p.m. clause in agreements. Some sellers assume it gives them extra time to stay in the home. In reality, this clause is only the latest possible deadline to complete the transaction, not permission to linger in the house.

In short: buyers expect the home to be empty and ready for them the moment the sale is finalized.

Planning ahead and ensuring the property is vacant avoids delays, frustration, and potential legal issues.

If you’re preparing to sell, keeping this in mind ensures a smooth, stress-free closing for everyone involved.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.