Author: KP & Associates

Oct 26, 2021 / Homeowners

5 Professionals Every Homeowner Should Know

No matter if you’re already are a homeowner or have ambitions to be one soon, having a reliable contact list of knowledgeable home service and real estate professionals on hand at all times is something everyone needs.

Whether you’ve just discovered a leak in your bathroom, a crack in your foundation, or that you want to learn more about refinancing your home, knowing who to call — as well as when to call them — offers homeowners the peace of mind they deserve.

Although you might not know just how much they’ll come in handy down the line yet, trust us when we say it’s better to have a comprehensive list of contacts ready for when you need them rather than scrambling to find someone at the last minute.

That being said, here’s our list of the five professionals every homeowner should know — or at least know how to contact.

1. A Stellar Mortgage Specialist

When attempting to buy a home, sometimes having a great mortgage specialist can be more useful than a great mortgage. Connecting with an experienced and talented mortgage professional can make all the difference in a house hunt, especially when they genuinely want to help you find a home.

Even if you already are a homeowner, cultivating a strong professional relationship with a mortgage specialist can pay huge dividends if you ever decide to enter the market again. First of all, they’ll know exactly how you can leverage your current assets (like your home) in order to build capital and get a leg up when applying for your next mortgage.

The tricky part is knowing where to find a stellar mortgage specialist. Our advice is to interview several and see which is most willing to help you achieve your homeownership goals. Go to banks, private lenders, and even ask your friends, family, and local real estate professionals for recommendations on who to speak to.

At the end of the day, go with your gut — if you want to build a long, meaningful relationship with your mortgage specialist, that’s most likely to happen with someone you genuinely connect with right off the bat.

Still on the search for your dream home? Look through our current collection of featured listings to see if your ideal next home is already on the market, then click “Find A Home” to let us know we can start searching with you.

2. A Resourceful Real Estate Lawyer

Similar to a great mortgage specialist, retaining the services of a resourceful real estate lawyer can save you more than just money when attempting to purchase a home. You can think of the duty of a real estate lawyer to manage and oversee every detail of your real estate transaction, from the terms and conditions in your Agreement Of Purchase and Sale to the transfer of Land Title.

It takes a lot of boring paperwork to process when buying a home, and it’s a real estate lawyer’s job to read through it all and inform you if there’s ever an issue or an inaccuracy in the fine print. They’re there to represent your best interests throughout a transaction and guide you through the process with as much confidence as possible.

That’s why it’s invaluable to have as good of a real estate lawyer on your team as you can afford, and why it’s vitally important to cultivate a strong relationship with them early on. Consider your real estate lawyer like your safety blanket — if anything starts to look questionable during your next home purchase, they’ll be there to cover your backside and jump into action on your behalf.

Helping to connect you with a top-notch real estate lawyer is just one step in our full-service approach to helping you buy a home. Learn more about what else we can do for you by visiting our Buying With Us page here.

3. A Helpful Handyperson

Next up on the list of important professionals to know is a helpful handyperson. If you’re reading this and thinking “I’m already quite handy around the house, I don’t need to know a pro,” then you probably are pretty capable of handling minor home improvement jobs. However, we still recommend you keep a reliable pro’s contact information on hand.

Even the most experienced, well-trained handymen and women will tell you they’re always learning on the job, and that there’s always a new skill or piece of knowledge to pick up. So when it comes to fixing a problem in your own home, you don’t want to find yourself in a position where you’re not quite comfortable or capable of taking on the task.

Plus, some jobs require more than one person to fix, so why not foster a professional relationship with someone you can trust to oversee a minor improvement job now instead of waiting until it’s too late?

Are DIY projects right up your alley? Give your home the refresh it deserves by following our 3 Creative Tips To Make Your Old House Look Brand New here.

4. A Cunning Contractor

In the same vein as our last point, it’s also essential for homeowners to make acquaintances with a talented home contractor too. These are the types of professionals you call on for when you need to make a major home improvement or want to set out on a larger renovation or remodelling project.

For these types of jobs, you’ll most certainly need at least one more helping hand, if not a trustworthy team of construction professionals. However, when taking on larger jobs like these, it’s vital that you as the homeowner can trust that the project’s progress and budget allocation are being managed efficiently.

While not every contractor is out there to take advantage of a homeowner and run up their bill, it’s unfortunately not that uncommon of an occurrence in the real estate industry. If you can find a contractor that earns your trust and makes you feel comfortable tackling larger projects around the house — especially if you can’t always be around to monitor them — then you’ll have done better than most homeowners by default.

One of the single best ways to increase the overall value of your home is with a home improvement project — but which ones will give you the most ROI? Find out what the 5 Best ROI Home Improvements For Sellers are here!

5. An Astute Agent

As always when it comes to anything to do with real estate and homeownership, it’s extremely valuable to know an astute agent. Not only will you work more closely with your real estate agent than any other person whilst navigating through the home purchase process, but they’ll also be able to connect you with any number of home service and industry-related professionals too.

It’s the duty of all great full-service real estate agents to help their clients in any way they need, whether that’s helping them find a trustworthy real estate lawyer, mortgage specialist, home service professional, or anything else.

Developing a personal and productive relationship with your Realtor® is also extremely beneficial to you as a homeowner (or future homeowner) too. Regardless of where you are in your homeownership lifespan, it’ll most likely be down to your real estate representative to help you locate and purchase the perfect home for you and your lifestyle.

That’s why it’s always advisable to foster a relationship with them so that your mutual understanding becomes second nature and your future house hunts become as close to effortless as possible.

Are you on the search for a real estate professional that always has your best interests in mind? At Karen Paul and Associates, we always do everything in our power to help our clients reach their maximum potential. Learn more about us and what some of our previous clients have to say about working with us here:

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Oct 20, 2021 / Homeowners

Your Complete Guide To Flipping A House

For many homeowners, the idea of managing even the most minor of renovations can seem daunting. For others, they’ve based their entire livelihoods on flipping homes and then selling them for a profit.

While you probably fit somewhere in between those two types of homeowners, you’re probably at least somewhat interested in flipping homes if you’re reading this article — and why wouldn’t you? There’s everything to feel good about when you take charge and commit to making improvements to your home, no matter if you plan on selling your home afterwards or not.

So, whether you’re ready to attempt a home flip for the first time or you just want to get a better gauge of everything required to fully flip a home, you can refer to this guide to help you reach your renovation dreams along the way. Happy flipping!

Step 1: Finding A Home

If you’re already a homeowner and you plan on flipping your current home, then there’s not much you need to worry about with this step. However, if you don’t already own a home or you plan on flipping a home that you don’t personally live in, then this first step is pretty important.

Not only will you need to tailor your home search to find a property with high flip potential, but you’ll also need to think about that home’s local real estate market. If you plan on flipping a home and selling it post-completion, then knowing what the health and conditions of that property’s local market are is pretty essential.

Your best bet here is to talk to a local real estate professional — even if you plan on buying a home in your own neighbourhood. They’ll not only be able to give you a full run-down of the current and projected real estate market stats for your chosen area, but they’ll be able to scour the market for homes ripe with flipping potential. And eventually, help you purchase that home at a price that makes sense for your entire project budget.

Are you ready to start searching for homes ahead of your upcoming flip? Browse through our current featured listings page or filter your search for more specific listings via our links below. If you see a property that catches your attention, reach out to us directly for more information.

Step 2: Securing Financing

Once you’ve targeted a certain neighbourhood and settled on a particular home you want to buy (or already own), it’s time to crunch some numbers. At this stage, we always recommend you seek the assistance and advice of a trained mortgage loan specialist, and preferably one experienced in working with home flipping clients.

In fact, it’s best at this stage to consult multiple different mortgage specialists so that you have multiple different mortgage loan options to choose from. If you need assistance finding a trustworthy mortgage lender — whether they’re associated with a public banking institution or part of a private group — your real estate representative should be able to help you here.

Even if you already own the home you want to flip, you can still take out a loan from a lender to help you finance your upcoming construction project. That’s why this step is one every home flipper should explore.

When you meet with your potential new mortgage lenders, be transparent about what your flipping plans are, what you estimate the total costs will be, and ask them how they can help make your flipping goals a reality.

If you’re interested in home flipping, you’ll love learning about the tried-and-true BRRRR method — a classic real estate reinvestment strategy. Read up on our blog post all about The BRRRR Investment Strategy here.

Step 3: Buy Your New Home

Just like Step 1, if you already own the home you want to flip, you might not find this stage particularly useful. That being said, it’s worth the read if you might want to make more of a career transition into professional home flipping.

Once you’ve secured your financing and know exactly which home or homes you want to target, this step is ultimately left up to your Realtor® to help you complete. As noted above, your Realtor® should work relentlessly to help you secure the home you want to flip for the best possible price under the best possible terms and conditions.

The more you’re able to reduce the amount of budget you allocate to actually purchasing a home, the more you’ll be able to spend during the construction phases.

At Karen Paul & Associates, we’ve helped countless home buyers in the Burlington and the surrounding area find homes that suit their highly specific needs — whether they’re homes to live or invest in, or homes they want to flip. Find out more about how we can do the same for you here:

Step 4: Blueprinting Your Plans

Now that you own the home you want to transform, it’s time to confirm your construction planning. If you’re planning on completing a substantial full-home flip, it’s in your best interest to not only meet with a seasoned and experienced domestic contractor, but also a reputable architect, too.

Even if at the outset of your home flipping project you have it in your mind that you want to handle most of the construction yourself, it’s always worth it to consult an experienced pro before getting started. Just like in Step 2, we advise you to meet and speak with multiple different architects, contractors, and construction groups before assembling your team and finalizing your blueprints.

After reviewing each construction and budget proposal from your potential build team, you’ll need to settle on one and move the project forward with full confidence. Remember, this is your home flip, so it’s your responsibility to lead your chosen team and ultimately make the tough decisions. The best thing you can do here is to surround yourself with a group of reliable, trustworthy, and intelligent professionals.

From there, all that’s left is to get your construction plans approved by your municipal governments, and then you’re all good to go — however, that could take longer than expected. Make sure to allocate at least a few weeks to have your construction plans approved by your municipality, and even longer if they’re rejected the first time around.

Can’t wait to get flipping, but not sure what to include in your new home designs? Use these creative home improvement ideas as inspiration during your pre-construction phase.

Step 5: Breaking Ground

Now that you’ve finally got all of your ducks in a row, it’s time to get started! Rule number one from here on out until you’ve completed renovations is time management. Time is money, and from the moment you break ground, the clock is ticking.

Even if you’re tackling most of your home flip on your own, you’ll be working against the clock to complete your renovations before your funding, your construction permit, and patience run out! And the pressure will be even greater if you’ve got an entire construction team working for you, as those professionals tend to be paid hourly.

Our tip at this step is to diligently manage a tight construction schedule. Make sure you regularly check in with your contractors, construction teams, and any other supplementary crews that are helping you out with your home flip throughout the duration of your project. Stay on top of their progress and hold them to deadlines and projected expenses. If not, you run the real risk of your timeline and budget extending much further than you’ll have ever anticipated, and that’s where home flips fail.

Once you own a fully finished home, it’s not always easy to part with it. If you’re not completely sure whether or not you want to sell your home after your flip, you could always rent it out. Find out what the best choice for you is by reading our post, Is It Better To Sell Or Rent Your House?

Step 6: Sell, Sell, Sell

Once you’ve completed renovations, the hard part is over and it’s time to revel in the results of your achievements. Your home is up to shape and you’re ready to list it on the market.

For many, this step is just the beginning of what can be a stressful and nerve-wracking real estate transaction, but for you, nothing will feel challenging after completing a full-on flip — especially when you have the right help by your side.

In fact, finding the right Realtor® to help you sell your home is probably the most important thing you can focus on at this stage. The right Realtor® will be able to immediately see the value in a fully-updated, newly renovated home that’s been brought up to modern living standards just so it can be sold at a profit. In all actuality, you’ve done your future Realtor® an enormous favour when it comes to preparing a home for sale as all that’s left for them to facilitate is staging, marketing, and selling your flipped home.

From here on out, patience is your best friend. Bide your time interviewing the right listing agent for you and your home, make sure you enter the market at the most opportune time, and most of all, don’t rush through this final stage just because you’re finally ready to be done with the project. You’ve worked hard to get to this point, so make sure these final few weeks get the attention they deserve and next thing you know, you’ll be rolling in the money you’ve made from a successful and lucrative flip.

When it comes to selling a home, having an experienced team of real estate professionals on your side of the negotiations table is key to your success. Learn all about How We Help Home Sellers here.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Sep 23, 2021 / Selling

5 Best ROI Home Improvements For Sellers

Heading into the season of change, most people involved in the real estate industry are gearing up for what always promises to be an active fall market. As people return from their holidays and children head back to school, the world begins to resume its regular routine, and so does the real estate market.

With that idea in mind, many homeowners eager to sell wait until the fall to list their homes as, traditionally speaking, more buyers recalibrate their focus on addressing their living situations. Knowing this, many of those homeowners eager to sell use the downtime in the late summer and early fall to make improvements to their homes in order to boost their property’s value.

We’re big fans of this idea, and recommend all of our sellers do the same ahead of listing their homes on the market — no matter which season it is.

So, to give you sellers some guidance and inspiration, here are our top five home improvements for maximizing ROI ahead of your upcoming sale.

1. Address Your Glaring Weak Points

While this point might feel somewhat underwhelming, it’s probably the most important on the list. It’s all well and good to go about improving your home overall, but if your property has a few spots in particular that have pretty prominent issues, those really should be addressed first.

What do we mean by glaring weak points? Well, things like a leaky roof, cracks in your foundation, unfinished rooms on your main or upper floors, or non-functioning home systems like heating, cooling, electrical, or plumbing.

While none of these improvements will be very ‘glamorous,’ they’re the ones that home evaluators, buying agents, and touring buyers will notice first — and more importantly, will be among the first things to detract from your home’s market value.

Our advice is to fix these first ahead of time so that when it comes time to have your home evaluated for safety and functionality, you won’t be hit with any surprises.

Real estate’s action-packed fall market is right around the corner — here are 5 Ways You Can Get Ready For The Busy Fall Market Now!

2. A Kitchen Remodel

As they say, the kitchen is the heart of the home, and for that reason, it’s among the first rooms in your home that buyers will want to see. That’s why a kitchen remodel is so important.

Although it sounds like a big job, you can make it as simple or complex as you want to. The main focus is that you improve the look, feel, and functionality of this high-traffic, hard-wearing space in your home.

If you want to keep things low-budget, consider doing things like repainting your cabinets a neutral colour like white and updating the hardware with something more stylish and sleek. Perhaps you can lay down some new budget-friendly flooring or even update a few smaller appliances like your microwave.

If you’re ready to take things to the next level, consider replacing your countertops with a more modern material like marble or a cost-efficient alternative. Then, add even more useful counter space with a kitchen island — if you’ve got the room, that is! Update as many of your old appliances as possible with stainless steel substitutes. And if you’ve got room left in your budget, update your backsplash with a simple neutral tile while you’re at it.

Curious to see how your neighbours’ listings have performed on the market recently? Look for comparable homes to yours on our Sold Properties page to find out.

3. A Bathroom Remodel

The same sentiment as completing a kitchen remodel can be applied to your bathroom, another high-use, hard-wearing room in your home. Bathrooms in older homes were also among the first to go out of date as well, with features like vanities, toilets, sinks, and tiles all susceptible to frequent stylistic and functional changes.

If you’ve got the means, replacing dated larger fixtures like sinks, tubs, toilets, and vanities always make an instant impact. If you don’t necessarily want to spend that much on your bathroom improvements, you can alternatively replace smaller aesthetic features like faucets, showerheads, and tiles.

Older wallpaper patterns in bathrooms should always be taken down and either replaced with wall tile or a bright, neutral shade of paint. Any chipped or broken tiles, especially obvious ones on the floor or within the shower should definitely be replaced too.

Lastly, any torn or mouldy caulking around your shower, tub, or sink should always be stripped away and replaced as well, especially seeing as it’s one of the simplest home improvement projects to do. Simply pick up a caulking stripper and caulking gun and flick on a YouTube how-to video — there’s nearly no way you can mess this one up!

Looking for some more transformative tips on how you can make your home look its very best? Read up on our 3 Creative Tips To Make Your Old House Look Brand New here.

4. A Deck Addition Or Revamp

If your home doesn’t already have a deck, porch, or patio in your outdoor space, building one is among the most sought-after additions to your home you can make, and the best part is, the costs involved aren’t that strenuous on a budget.

All it takes is some pressure-treated lumber and a few trips to the hardware store to gather all the materials you’ll need, plus the cost of having an outdoor space specialist install everything for you.

If you do already have a deck or patio space, improving it with some sandy, refinishing, or repainting will give it a welcome facelift ahead of listing. You can also opt to add more visually interesting elements too, like planter boxes, modern fencing, or ambient lighting to add even more value to your outdoor oasis.

Not sure whether you’re quite ready to sell your home just yet? Read our related blog post “Is It Better To Sell Or Rent Your House?” here to help you make up your mind.

5. Finish Your Basement

When the COVID-19 pandemic initially forced strict lockdowns across the country, many Canadians were left feeling cramped and uncomfortable having to spend extended periods of time at home. With offices, gyms, schools, and daycares all forcibly shut, even modestly-sized homes began to feel like their walls were closing in.

This was one of the biggest motivating factors for who the real estate industry calls ‘upsizers’ to enter the market and seek larger homes. For this reason, adaptable bonus spaces like attics, lofts, spare bedrooms, and most of all, basements, became highly sought-after. And, it’s exactly why there are substantial returns to be made when selling a home if you spend some time and effort upgrading your basement space.

Having the potential for designated office space in your home is one of the most highly valued features among homebuyers today. Learn all about Setting Up Your Home Office here.

Whether your basement isn’t entirely finished or it just needs a few touch-ups here and there, putting in the work to get it up to a liveable standard will provide your home with some enormous ROI come closing day.

No matter if you stage it as a home office, home gym, spare room, or even a separate apartment-style income suite, the eyes of today’s buyers will light up when they see your home already has a basement ready for action from move-in day.

Keen to get your own home sale up and running? Read our guide on how to sell your home in Ontario below, then learn how to set up a no-obligation selling consultation with us by clicking on the ‘Sell Your Home’ link.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Sep 14, 2021 / Selling

Is it Better to Sell or Rent Your House?

For many homeowners, when they outgrow their “starter” home, they decide to sell it and then move onto a bigger place. However, did you know there might be another option available? For some homeowners, particularly those with real estate investing ambitions, it makes sense to actually rent their old home rather than sell it.

Let’s take a closer look at the pros and cons.

You Can Build More Wealth in the Long Run

Real estate investing is a long-term strategy to build wealth. Although the market can fluctuate, for the most part, real estate will almost always appreciate in value. Owning two or more properties will help you expand your wealth and grow your investment portfolio.

If the mortgage is paid off on your first home, any rental income will just be added as positive cash flow, but if you’re still paying a mortgage, your renters will essentially be paying the mortgage for you.

However, before you make the choice not to sell your home, and rent it instead, there are a few things you should consider.

Interested in investment properties? Take a look at our blog about the BRRRR Method for investing here.

What Will the Cash Flow Look Like?

Before deciding to sell or rent, consider the numbers. Add up all the monthly expenses, and then realistically estimate how much you could charge for rent. If the number is in the negatives or is too low for you to consider taking on the responsibility of becoming a landlord, it’s better to sell.

The return on investment (ROI) is important as well because it will mean how much profit you make and how quickly you get it.

For example, let’s say you sell your home and make a $50,000 profit, that’s money in your pocket right away. However, if you rent your home, after paying all the expenses and collecting rent, you might only see a positive cash flow of $1,000 per year. Although your investment will no doubt appreciate over time, you can see how a one-time payout of $50,000 might be more desirable than annual profits of $1,000.

Karen Paul and Associates offers fantastic turn-key services specifically designed for investors. If you’re thinking about investing in real estate and growing your wealth, take a look at some of the services we offer here.

Consider the Area

If you are currently living in an area that is in the midst of a redevelopment, it might be more beneficial to rent for now and then sell later. However, if you notice your town’s growth moving away from your property, it’s better to sell sooner rather than later.

It’s almost impossible to predict with absolute certainty what a city’s development will bring, but you should be able to see a few signs that might predict things moving one way or another.

Wondering if your area is on the way up? Read our blog on how to tell if a neighbourhood is improving here.

Are You Prepared to Be a Landlord?

Renting a house is more than just collecting a rent check every month. It’s a big responsibility that requires care and consideration and shouldn’t be a decision that you take lightly.

As a landlord, you would be responsible for maintenance, emergency repairs, and ensuring your tenants have a healthy and safe place to live. Additionally, dealing with tenants requires management and interpersonal skills.

If you want to be a landlord without handling the day-to-day responsibilities and repairs, you can also employ a property management company to handle these logistics for you. However, this is just another added cost that could eat into your ROI.

Interested in learning more about real estate investing? Reach out to us today here to get the conversation started.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Aug 27, 2021 / Selling

5 Ways You Can Get Ready For The Busy Fall Market Right Now

Every year like clockwork, the real estate industry collectively begins to gear up for fall and what always promises to be an active and exciting market. No matter where you’re based, it seems that the fall real estate market is always a busy time of year for buyers and sellers alike.

That being said, however, buyers and sellers don’t really need to prepare for the fall market in the same way. While buyers will be sorting out their finances and getting mortgage pre-approvals, sellers are required to do quite a bit more to get their homes up to market-ready condition.

So, if you’re planning on selling your home this fall, the best piece of advice we can give you is to start preparing now. To save you a lot of stress and headaches down the line, here are five ways you can get your home ready for this fall’s busy market right now.

1. Address Any Problem Areas

If you’re looking to truly maximize the market value of your property and sell it for its highest possible price, the very first thing any seller should do is address any damaged or dysfunctional areas of your home.

Whether you hire a professional home inspector or take on the job yourself, it’s essential you identify any parts of your home that are in need of some maintenance before listing it on the market. Why? Well, if left damaged or unrepaired, these are the first things buyers will use to try and negotiate a lower price for your home.

If your home is clearly in need of some work, buyers will want to take the cost of repairing it out of their initial offer. Things like water damage, rotting wood, defective home systems, and even leaky taps are among the most obvious to spot, so if you’ve got any number of these issues it’s simply not worth listing your home for sale without fixing them first.

Want to know what homes just like yours have recently sold for? Do some market research and check out Our Sold Listings Portfolio here.

2. Declutter, Declutter, Declutter

One of the easiest things you can do to bring your home up to visitor-ready condition is to do some merciless decluttering. Getting all of your extra stuff out of the way before showcasing your home to visitors is essential when selling, and the good thing is it’s something you can start doing bit-by-bit far in advance.

The reasons for decluttering your home should be pretty straightforward — no buyer wants to have to try to look past all of your extra stuff in order to get a good idea of what your home looks like when seeing it in person or in photos. Plus, by getting rid of all your unnecessary personal items, your home will appear more spacious and easier to navigate for potential buyers during home showings.

Not sure where to start? Some of the biggest culprits for collecting clutter are places like closets, countertops, basements, and spare rooms. Also, prioritize keeping high-traffic areas like hallways, doorways, and staircases clear of any clutter or obstacles. The idea here is to make your home feel nice and easy to walk around in for your potential buyers during tours.

Looking for some more things you can do ahead of time to help prepare for your home sale? Read about our Top 3 To-Do’s Before You Sell Your Home here.

3. Get Cleaning

Now that you’ve got all of your extra stuff out of the way, you’ll probably notice you’ve been housing quite a few more dust bunnies than you previously knew about, and now’s the time to find them a new place to live.

Before any buyers even see so much as a picture of your home, it should look as immaculately clean as possible from top to bottom. Yes, this includes windows, walls, cupboards, and cabinets too. For a proper deep clean, we always recommend our sellers get help from a team of professional cleaners, though if you think you can do most of the job yourself, that’s always welcome too.

Are you the proud owner of a few furry friends? While pets are definitely adorable housemates, they do tend to complicate things a little when selling your home. To help you out with that, here are our 5 Tips On Selling Your Home With Pets.

4. Lay On A Fresh Coat

Next up on the sellers’ to-do list is to revisit your home’s paint situation — both inside and out. If you’ve ever had your home painted before, you’ll know first-hand just how big of a difference it makes, which is why we recommend you lay on a fresh coat in some key areas before your potential buyers arrive.

While we wouldn’t expect you to re-paint the entire exterior of your home, touching up a few highly visible accents can make a huge difference. Places like your front door, window frames, and mailbox always benefit from a fresh new pop of colour, while any chipping or patchy paint jobs elsewhere should be retouched too.

Heading inside, the walls and ceiling in rooms like your living room, dining room, kitchen, and bedrooms should all be refreshed as well. In terms of colour, these should all ideally be painted in a warm, neutral colour like white, off-white, or light grey.

Not only will painting your rooms in a light neutral colour appeal to the widest audience of visiting buyers, but basic colour theory tells us that lighter coloured rooms also feel larger and more spacious than darker coloured ones. So when it comes to choosing a paint colour, keep it simple and stay away from anything too bold.

Unmentioned on this list of preparatory tasks: staging. Learn more about the power of staging when selling your home by reading about A Few Staging Tips For Sellers here.

5. Book Temporary Accommodation

The last thing you can do to prepare for a smooth and successful home sale is to make some travel plans. During the home showing process, it’s always ideal if you, the homeowner, are out of your home when tours are taking place — and this fall, the reasons for doing so are two-fold.

Firstly, home showings always function better for buyers when the owners of the home they’re visiting aren’t there. The atmosphere of their tour is less awkward or stressful without the presence of the current owners there, plus it heavily detracts from buyers’ ability to picture themselves living in your home. Instead, all they really think about is what your home will be like without you in it.

Secondly, in order to host in-person home showings this fall, Realtors® are going to need to follow strict health and safety guidelines to mitigate the risk of spreading COVID-19. Even though you might be fully vaccinated and testing negative for the virus, it’s still much riskier to have more people present during the showings than necessary.

Therefore, one of the best things you can do to ensure the showings process goes as smoothly as possible is to ensure you’re out of your home when potential buyers come to see it. Confirm with your Realtor® when the majority of your home showing appointments will be and make accommodations to be elsewhere when that is. Whether you book a weekend away somewhere special, rent an Airbnb close by, or stay with family or friends, the important thing is you’re out of the way.

At Karen Paul & Associates, our main objective when helping clients sell their homes is to make the entire process as easy as possible for them. See what we do to help by reading our guide to Selling A Home In Ontario.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Jul 27, 2021 / Blog

Setting Up Your Home Office

The last year and a half have altered almost every facet of life. Some of the largest changes have occurred in the workplace – quite simply, we work differently now.

As the masses left the highways and tall office buildings, they began setting up shop in the nooks and crannies of theirs homes – in spare bedrooms, at the dining room table, even on the couch…. The longer this work-from-home trend lingers the more it becomes the new normal – the more important it is to have a space dedicated for your “office”.

Here are some tips to ensure you are making the most of your space.

1. Location

Home offices come in many different sizes and are the key to ensure you think about where and when you do your work. If you’re a busy mom, the kitchen table could be an ideal place as you can for your central command. If you’re a busy professional who spends your day on the telephone then space away from household distractions would be a better fit.

2. Allow Enough Space

Professional designers say to allow at least 60 inches in width and 84 inches in depth. Make sure you have enough space for the tasks, you must complete.

3. Spend the Money on a Good Chair

This cannot be overstated enough! Quality chairs are not cheap but they can contribute to your comfort more than any single piece of office furniture. Your back and neck will thank you!

4. Storage and Shelving

This is your new office – you will need space for storage. Plan for it before you need it. There are many options, whether storage cabinets, shelving units, or simply a well-thought-through closet reno. The key here is to plan and have the space ready before you need it.

5. Lighting

The lighting types and levels in our environment have been scientifically proven to affect our mood, performance, and productivity levels. Everyone has their own preferences and serious thought should be given to this. Natural light is preferred by most; however, advances in lighting technology have produced some exciting alternatives over the decade.

This is the new reality for many – invest in yourself and your new space and the ongoing productivity and comfort that you will experience will be worth every ounce of effort you have had to put into this new venture.

Written by:

Colin Gainham of Karen Paul & Associates

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Jul 13, 2021 / Uncategorized

Cost Efficient Ways to Heat Your Pool in The Summer

Summer is getting nearer and the last year has seen a huge rise in demand for home swimming pools.

If you are a new swimming pool owner, you may be wondering how to heat a swimming pool for free of almost free. You may not have selected the pool heater you want to use. Or the heaters you have looked at may not be cost-effective.

2 Contributing factors for economical pool heating are Solar Power and Heat Retention. Let’s look at some inexpensive ideas.

Black Hose Trick:

All you need to do is buy a black garden hose.

Purchase a black garden hose long enough to travel the distance from your pool pump and into a sunny area with 100 feet to spare. To keep your pool warmer, puck a spot on the deck or on the roof of your house.

After you’ve chosen the spot, it is time to unravel your hose. Connect it to the return in your pool pump. You can do this using a tap style connection.

Once you have attached your hose, run it to your chosen sunny spot.

Wrap all of your spare hose into a coil. The coil will help the hose to remain warm. Then run the remaining hose into the pool.

Warm water will circulate through this heated coil, creating a pool water heater to increase your water temperature.

Solar Cover/Blanket:

One of the main causes of heat loss in a pool is evaporation. Water evaporates during the day. Gusts of wind and the heat of the sun cause water loss. When you remove water that is already warm, you will cool down the temperature of your pool by adding cooler water. This is unless you prevent the evaporation from occurring.

A solar cover presents the perfect barrier to evaporation. It not only provides a shield against water loss but also acts as a cheap pool heater. This is because a solar pool blanket will help you retain heat.

Solar Panels:

Solar Panels convert sunlight into energy. They are cost-effective and an environmentally friendly way of heating a pool. They can also be combined with electric heating systems to add warmth to your pool.

If you are wondering how to quickly heat a pool, solar panels are your best option. Combine them with your electric or gas heating system for rapid results.

The cost of installing this heating for pools will depend on the size of your pool and the number of panels you will need. You’ll also need to find out the capacity of the panels you wish to install. The larger your family, the more energy you will need to heat your pool.

Solar Dome Connectors:

Solar dome connectors work in a similar way to solar mats. However, with a dome connector, the piping rolled up into a dome shape. Heating for pools takes place within this dome.

Solar domes take up far less space than solar panels. An 8 x 4 meter pool which is 1.5M Deep will only need ten domes. This is because each dome heats up a large amount of water.

It is best to use solar domes for small pools. This is because, like solar panels, domes are dependent on sunlight. You will also use some energy to push water through the domes. Domes are slightly cheaper to buy than solar panels.

Solar Rings:

If you want to solar heat your pool but are not yet ready to buy a solar pool blanket, you could always use solar rings.

Solar rings are like a solar pool cover broken into smaller rings or circles. They make cost-effective heating for pools. They are also very easy to use.

All you need to do is throw a couple of solar rings into your pool. The amount you will need will depend on the surface area of your water.

Your rings will absorb heat while they float. They will also connect to each other, locking together to hear your pool. This is because each of the solar rings has a magnet that attracts them to one another. Solar rings create 21,000 BTUs of heat per day.

Hope these tips on how to heat your pool efficiently and inexpensively help you keep warm in the water this summer!

Written by:

Troy Challe of Karen Paul & Associates

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Jun 2, 2021 / Selling

3 Creative Tips to Make Your Old House Look Brand New!

Updating older homes can e costly, confusing, and even daunting. this is with good reason, as older homes often pose unique challenges, sometimes requiring extensive renovations to fully update each aspect of the house. It isn’t surprising then, that people often look to less costly (and perhaps even more creative) ways to make older homes “look brand new.” As Realtors, we are aware that the little things can make a big difference. In this short blog, we’re going to touch on three things that can help you make your old house look brand new, without breaking the bank!

So, what are they? Check out our 3 creative tips below for house to make your older home look brand spanking new!

1. Incorporate Plants into Your Lifestyle

Incorporating plants into your home can be a great way to bring colour and pizzazz into older properties. Plants can come in a dizzying array of shapes, sizes, and colours, and can be placed, hung, and perched in different areas throughout a home, making them one of the best accessories available. A well-placed and adequately sized plant can turn an otherwise drab room, into a light, more modern living space. Don’t miss out on grabbing a plant or two to spice up your house!

2. Get Painting!

Giving your home a makeover can be a great way to make an older home look newer. We’re not talking about a full makeover – Don’t Worry! Instead, think about giving your home a partial makeover, that involves strategically painting areas of the home that you spend a lot of time in. For the DIYer’s, this can be a great way to engaging a project where the end result is truly noticeable, Pro-tip: use lighter colours, such as white and beige, which can transform a room, making it bigger, brighter, and ultimately better!

3. Less is More: Get Cleaning!

Getting rid of clutter around your home can be a great (and cost-effective) way to make spaces look newer. Doing a full clean, (yes, we know it might not be the most fun way to update your home) can help give your home a lighter, newer feeling. You’ll want to make sure you’re thorough though, as a halfway clean won’t get the job done. Organizing your stuff can transform your home in ways you might not have even known were possible.

Accessorizing the look of your home is a great way to improve its overall image. Try to incorporate plants into your home to give it a brighter feel. We would also recommend painting some of the most used area of the house, as a newer coat of paint can be a great way to brighten up a room, and even make it look bigger than it really is! Finally, you might be surprised how big a difference a thorough clean can make. To be clear, we’re not just talking about scrubbing the walls and floors (although that’s never a bad idea). What we’re really talking about is getting rid of those items you don’t use anymore! When you’re searching for something new, sometimes, less is better. And in this case, less is more! Don’t be discouraged or intimidated by the home renovations that you think are required to update an older home, because most of the time, they aren’t! Instead, focus on smaller and more creative things that can impact your home!

Written by:

Josh Shenker of Karen Paul & Associates

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Apr 29, 2021 / Blog

Geothermal Systems

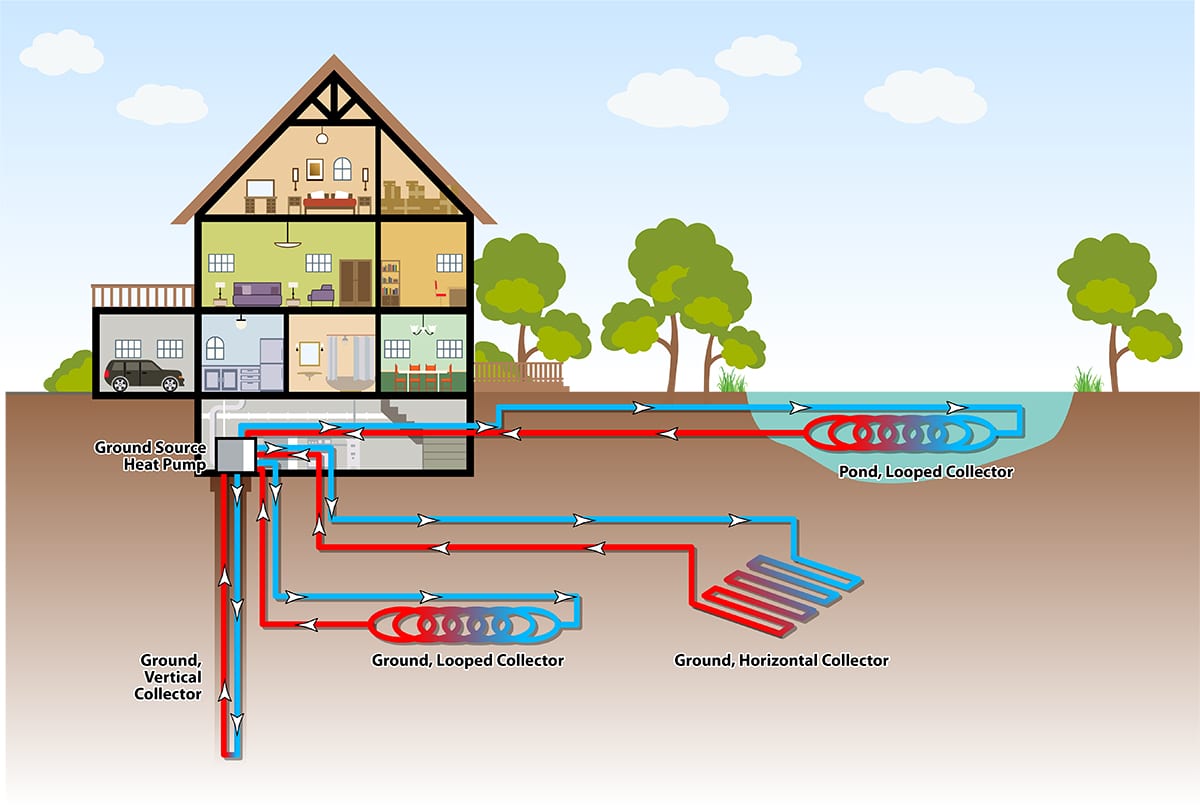

In the last decade, there has been an increased focus on reducing our carbon footprint and reducing energy emissions. As such, Geothermal heating and cooling systems are growing in popularity with homeowners as an alternative to traditional HVAC systems. Geothermal systems have a history longer than most realize. In 1892 the first district heating system was developed from hot springs in Boise, Idaho, and eventually heated 200 homes and 40 businesses. Advances in technology have made geothermal heating and cooling systems commercially viable and suitable for residential applications.

Geothermal systems for heating and cooling use Ground Source Heat Pumps to exchange heat with the ground. Counting on the fact that ground temperatures consistently range between 7 to 24 degrees Celsius the ground can be used as a heat source or a heat sink. Once installed in a home, geothermal systems can save 20-60% on utility bills and offer a relatively short “payback period” of about 7 years. They are low maintenance and energy-efficient.

The most common type of geothermal system being used for residential purposes are “Loop Systems”. Specifically, Closed Loop Systems. Closed-Loop Systems are made up of a mesh of interconnected pipes buried in the ground. A liquid refrigerant is pushed through the “loops” by a heat pump and thus the pipes act as a heat exchanger. The most popular orientations of these loops are vertical and horizontal.

Vertical Loops are oriented in a vertical direction. Holes up to 400 feet deep are drilled in the ground and U-tubes are placed in them. Multiple U-Tubes are connected together and then connected to a pump and optional compressor. Vertical Loops are ideal for smaller lots as they require much less surface area.

Horizontal Loops are just the opposite of vertical loops. The U-Tubes are laid in shallow trenches from 1-3 meters deep and approximately 400 feet in length. These systems are less expensive to dig but require a much larger amount of surface area.

Definitely consider a geothermal system. Heating needs represent an estimated 42% of home energy consumption. Even a small geothermal system can be a cost-effective way to supplement your heating and cooling needs.

Written by:

Troy Challe of Karen Paul & Associates

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.

Apr 28, 2021 / Blog

The BRRRR Investment Strategy

This is an investment strategy that has been gaining a lot of traction in Burling and in the Halton Region in recent years and we are here to break it down for you. This is the perfect mix of house flipping and rental property investing. Why has it become so popular? It is simple – this strategy has the potential to increase net worth and deliver substantial monthly cash flow very quickly.

BRRRR stands for:

Buy, Rehab, Rent, Refinance, Repeat

Buy: You find a dilapidated house that needs substantial renovations and purchase it under market value. You are targeting real fixer-uppers in “decent” neighbourhoods. These purchases are usually funded using short-term funds meaning private money and private investors and not your large charter banks.

Rehab: Fix it up! It is prudent to set a budget and stay within it as capital costs in renovation projects are notorious for ballooning over budget. It is time to get your hands dirty – you want high-end finishes as this will help attract that A-Class tenant at the end of the project. Great houses attract great tenants!

Rent: Find the perfect tenant to rent out the house. Do your homework – hire a Realtor to help – it is important to have a trustworthy individual on the lease who pays every month on time. The cash flow of this project will rely on the quality of tenant you can secure.

Refinance: Refinancing the property at a much higher valuation compared to its purchase price will allow you to free up a lot of capital. FYI – A bank will typically want 6 months to 1 year of ownership before refinancing a home and max out around 80% loan to value. Every situation is unique, and it is important to understand the numbers while putting together your projections. Do your homework! After the refinance has been secured you use this money to pay off the short-term lender. Have your debt in a long-term mortgage with much lower interest rates, and leftover capital can be used to move into the next project.

Repeat: Do it all again!

As with any investment strategy, there are risks associated with it. If you would like to learn more on how to minimize these risks then reach out to Karen Paul & Associates and we would be happy to dive deeper into this strategy and see if it a good fit for your portfolio

Written by:

Colin Gainham of Karen Paul & Associates Inc.

Interested in learning more? Send us a message here and we’ll be in touch with you soon after.